In an Operating Lease the Lessee Records

Variable payments based on an index. The lessee has a purchase option to buy the leased asset and is reasonably certain to use it.

Lease Accounting For Operating Lease Lessor Vs Lessee Recording Of Asset Leased Amortization Schedule Standard Operating Procedure Template Accounting

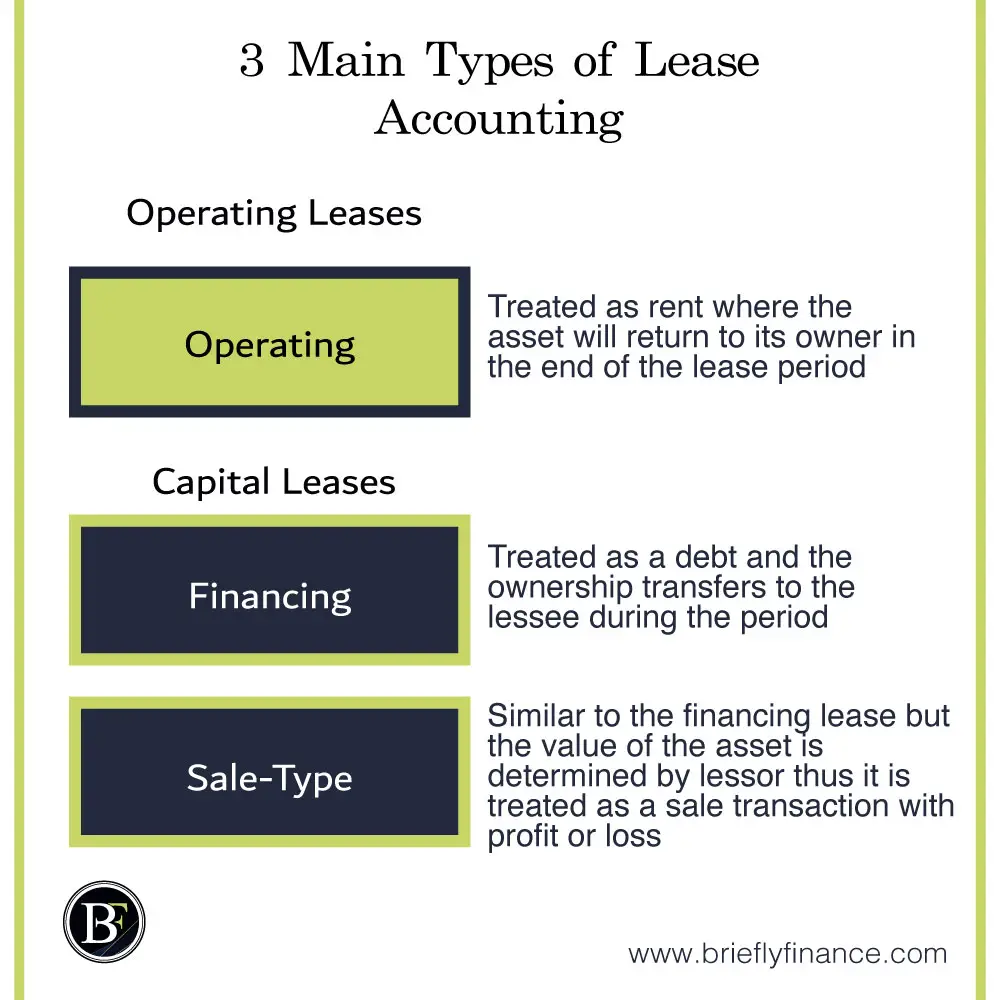

The accounting for an operating lease assumes that the lessor owns the leased asset and the lessee has obtained the use of the underlying asset only for a fixed period of time.

. In operating lease assets are not capitalize. While the lessee records asset rent on the income statement and doesnt have any recordings on the balance sheet. A lessee with a finance lease containing a bargain purchase option should depreciate the leased asset over the.

The lessee records an asset and a liability for the present value of lease payments. During the rental period the lessee typically has unrestricted use of the asset but is responsible for the condition of the asset at the end of the lease when it is returned to the lessor. An operating lease is an agreement to use and operate an asset without the transfer of ownership.

This means the total lease payment is divided over the term of the lease to get the monthly instalments. Operating Lease Accounting by Lessee. The lease term covers the major part of the underlying assets remaining economic life.

By renting and not owning operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. In an operating lease the lessee uses a _____ approach to record the same amount of lease expense over the lease term straight-line In a _______ lease if the FV of the leased asset is less than the PV of the minimum lease payment then the lessee records the leased asset and obligation at FV. If an operating lease has scheduled changes in rent normally the rent must be expensed on a straight-line basis over its life with a deferred liability or asset reported on the balance sheet for the difference between.

Where there is a lease of land and building and the title to the land is not transferred generally the lease is treated as if a. Experts are tested by Chegg as specialists in their subject area. An operating lease Lease payments include.

Based on this ownership and usage pattern we describe the accounting treatment of an operating lease by the lessee and lessor. In an operating lease the lessee reports both interest expense and amortization expense on the income statement. Amortization expense and interest expense.

The lessee records an asset and a liability for the total of the lease payments. Term of the lease. An operating lease is the rental of an asset from a lessor but not under terms that transfer ownership of the asset to the lessee.

Start your trial now. Assets remaining economic life. In computing the present value of the lease payments the lessee should Use the implicit rate of the lessor assuming that the implicit rate is known to the lessee.

Weve got the study and writing resources you need for your assignments. The lease is expensed using the straight-line method over the duration of the lease. The lease transfers ownership of the property to the lessor.

We review their content and use your feedback to keep the quality high. Under an operating lease the lessee enjoys no risk of ownership but. In the accounting of an operating lease the lessee records rent expense or debit over the term of the lease and credit to the cash or rent payable.

The land is finance lease. In an operating lease the lessor records a receivable for the present value of lease payments. Who are the experts.

Amortization expense and lease expense. A guaranteed residual value. Ownership of the underlying asset is shifted to the lessee by the end of the lease term.

Solution for Financing Lease the Lessee records an Asset and a Liability Multiple Choice False True. Operating Lease Accounting can be done by considering that the property is owned by the lessor and it is only used by the lessee for a fixed tenure of time due to which the lessee records rental payments as expense in the books of accounts whereas lessor records the property as an asset and depreciates it over its useful life. Start your trial now.

Operating lease is the lease other than finance lease. 1 Financial Statements And Business Decisions 2 Investing And Financing Decisions And The Accounting System 3 Operating Decisions And The Accounting System 4 Adjustments Financial Statements And The Quality Of Earnings 5 Communicating And Interpreting Accounting. First week only 499.

In an operating lease the lessee records a right-of-use asset and amortizes it not on a straight-line basis but by plugging the right-of-use asset amortization at whatever amount is needed to cause interest plus amortization to equal the straight-line. This is considered to be 75 or more of. True False False If it is probable that the expected residual value is less than the guaranteed residual value the difference should be included in the computation of the lease liability.

2- In an operating lease the lessee records Lease expense 3- The lease receivable amount includes the present value of rental payments plus the present value of guaranteed and unguaranteed residual values. An operating lease differs from a capital lease so it should be treated differently for accounting purposes. Common assets that are leased include real estate automobiles aircraft or heavy equipment.

III a bargain purchase option. The land and building are an operating lease. The land is operating and the building is finance.

Solution for n a finance lease the lessee records interest expense only. This question was created from Quiz 5 Chapter 21docx. In an Operating Lease the Lessee records an Asset and a Liability true or false Accounting Business Financial Accounting ACCT ACC 2101 Answer Explanation Unlock full access to Course Hero Explore over 16 million step-by-step answers from our library Get answer.

Under an operating lease the lessee records rent expense over the lease term and a credit to either cash or rent payable. The land is finance and the building is operating. In an operating lease.

Life of the asset or the term of the lease whichever is longer. First week only 499. In this case only the lessor must register its credit with the lessee because the operating leases are determined as financing outside the balance sheet therefore a leased asset and associated liabilities of future rental payments should not be presented in the.

In an Operating Lease the Lesseerecords an Asset and a Liability. The lessor records interest revenue. In an operating lease the lessee records journal entry.

In an Operating lease the lessor records Leased asset on the balance sheet and interest revenue and depreciation on the income statement.

Hyperledger London 2 Car Leasing Car Lease Business Networking Blockchain

No comments for "In an Operating Lease the Lessee Records"

Post a Comment